Abstract

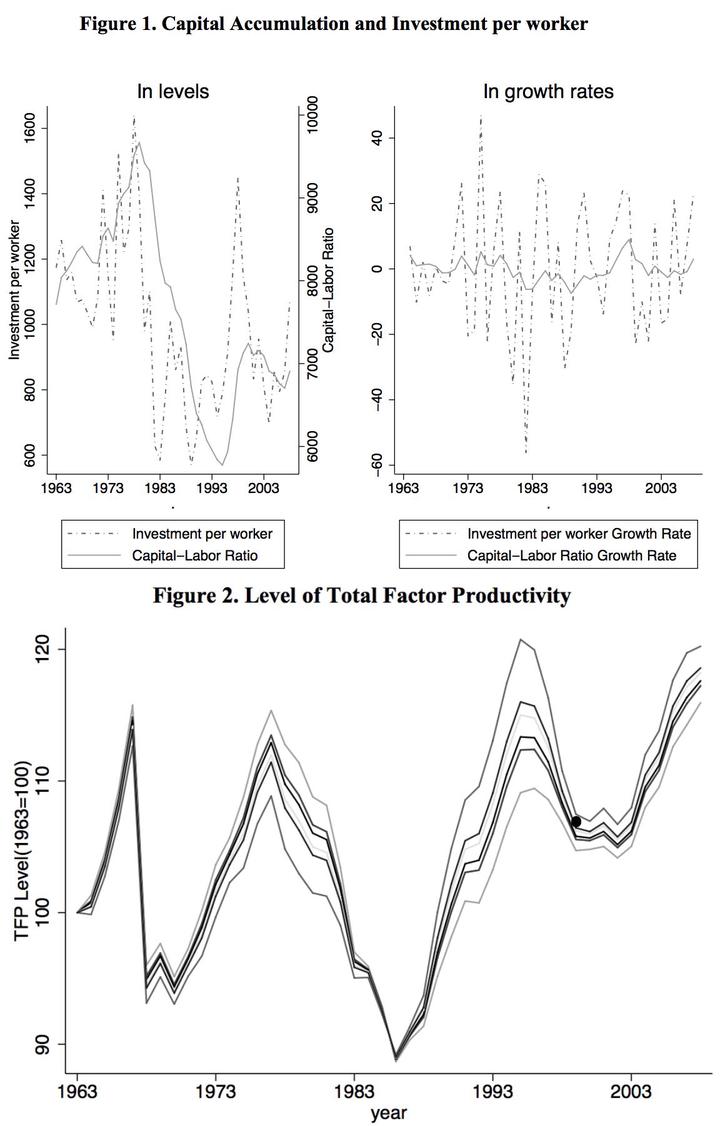

Bolivia has suffered from a series of investment constraints and negative productivity cycles in the last half-century. In this context, this article first presents suggestive empirical evidence that physical capital accumulation has been constrained by high volatility in investment per worker, low marginal product of capital, and high adjustment costs. Next, the article presents evidence about the cyclical behavior of Bolivia’s total factor productivity (TFP) during the 1980-2008 period. As expected, the cyclical dynamics of TFP are shaped by cyclical variables such as terms of trade and fluctuations in the real exchange. However, economic policy variables (such as macroeconomic stabilization and external debt management), institutional variables (such as democracy and civil rights) and initial conditions also appear to be significant when explaining the behavior of Bolivia’s TFP.